ASSESSMENTS

Information taken from the Saskatchewan Assessment Management Agency (SAMA) website.

What is an Assessment?

An assessment is the act of determining a property's value.

What is the relationship between property assessment and taxes?

The key difference is that assessment is SAMA's responsibility while the task of setting property taxes is the responsibility of municipal governments. The relationship between assessment and taxes comes from the fact that municipal governments levy taxes as a mill rate that is charged as a proportion of a property's assessment value. Since the starting point is the assessed value, it is important to make sure that each property's value is assessed fairly by SAMA.

Why did the value of my property change?

One of two things may have occurred. The real estate market may have changed. Market forces are the usual cause of a change in assessments. These changing market forces are seen every four (4) years when SAMA does a REVALUATION that updates assessment using a new base year. A Property may also have been changed. For example - the buildings may have been upgraded. This change in physical data can happen at any time.

Why is it that my assessment value may not match what I just paid for a property, or what another appraiser said my property is worth?

To create an equitable system, SAMA determines assessments that reflect long-term values, an avoid short-term market fluctuations. The selling price for any individual property is always subject to short-term, local market conditions, and to the negotiations of each buyer and seller. As for fee appraisers, they also focus on immediate, actual, local market conditions, not on long-term fair value. Even their assessments, however, may not be the same as what an individual buyer and seller may agree upon when selling a property.

What happens if I disagree with my property's assessed value?

There is an appeal process you can follow. Contact the RM office or SAMA regional office.

I'm not sure if I should appeal. How can I find out if the assessment of my property is accurate?

First, contact your local municipal office and ask if an assessment open house or information meeting has been scheduled. That will be an important source of information. You can also contact the nearest SAMA office. They would be able to discuss the methods used to arrive at the value of your property.

Who decides how assessments are done?

The policies, procedures and standards for assessment are determined by SAMA, and must be followed by all Saskatchewan municipalities. This job is mandated to SAMA by provincial legislation titled The Assessment Management Agency Act.

Who conducts assessments?

Each municipality determines who will conduct the assessment of its properties. SAMA has staff, expertise and regional offices to provide this service, and is contracted by many municipalities to do their assessment maintenance, revaluation and reassessment work.

What is "base date"?

The base date is the year on which property assessments are determined. For that reason, revaluations are done very four (4) years so that assessed values remain as up-to-date as possible.

When is the next revaluation?

Every four (4) years, therefore the next revaluation will be completed in 2021, 2025, 2029 and so forth.

For more information click on the link below to visit SAMA's website at:

https://www.sama.sk.ca/municipality-government-services/new-councillors

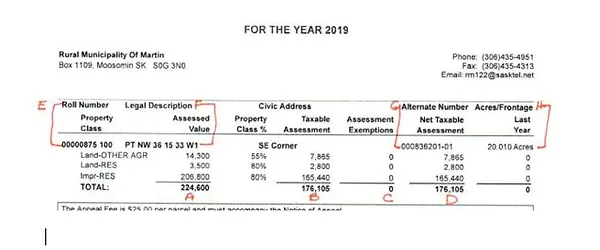

ASSESSMENT NOTICE

The Assessment Notice is NOT a tax notice and does not equal property tax. An Assessment Notice is a notice that is sent to a Ratepayer either every four (4) years after a Re-Valuation (basically a review of the entire province’s assessment) or anytime there is a change done to a property.

The Values on the notice are determined by the Saskatchewan Assessment Management Agency (SAMA) for the Municipality. In a nutshell the notice is telling you what your property is worth compared to other similar properties. The Assessed Value is not necessarily the selling price of your property or even what your insurance company or bank would consider the value of the property. Generally, properties are sold for anywhere from 2 times or more the Assessed Value.

Your notice will tell you numerous things and are briefly described below:

A. This is the Assessed Value of your property. You may see the value broke down to different areas (ie Land-OTHER AGR, Land-Res, Impr-Res etc). Land OTHER AGR is Agricultural Land (land that could be farmed), Land-Res is the amount of land in a subdivision that is considered part of the house yard, Impr-Res is Improvement Residential (house).

B. Taxable Assessment is a calculation of the Assessed Value X Property Class%. Basically, this value is what Legislation dictates Property Taxes are calculated from. Residential Land has a Property Class of 80%, Cultivated Farm Land has a Property Class of 55%, Non-Arable/Pasture Land has a Property Class of 45% and Commercial Property is 100%. Take the Assessed Value type and multiply by the Property Class

EXAMPLE: Impr-Res Assessed Value 369,500 x Property Class 80% = 295,600

C. Assessment Exemptions is a section where any allowable exemptions to the Taxable Assessment shows a value. Generally, you will see an exemption on the House (Residence) if you own farm land. The Municipalities Act Section 293 allows for the Taxable Assessment of farm land to be used to exempt the Improvement (House). Whatever land you own and rent in the Municipality and adjoining municipalities may be used (if not already used on other property) to lower the Taxable Assessment of the House.

D. Net Taxable Assessment is the end value that is used by the Municipality to calculate taxes and is the Taxable Assessment MINUS Assessment Exemptions

E. Roll Number is a unique number to your property on the Municipality’s Tax System

F. Legal Description is your land description

G. Alternate Number is a unique number to your property that SAMA uses to identify your property

H. Acres is the amount of acres on your property

For more information please click on the link below:

https://www.sama.sk.ca/document-library-news/educational-publications